GROUP

- TOP

- Sustainability

- Environment

- Response to Climate Change (Disclosure Based on TCFD Recommendations)

Sustainability

Response to Climate Change (Disclosure Based on TCFD Recommendations)

About the TCFD

The Task Force on Climate-related Financial Disclosures (TCFD) was established by the Financial Stability Board in December 2015. In order to reduce the risk of financial market instability, the TCFD recommends that companies assess the financial impact of climate change risks and opportunities on their operations and disclose their governance, strategy, risk management, metrics and targets.

MIDAC Group Sustainability Policy

Based on our management philosophy, the MIDAC Group's sustainability policy is to pursue sound, fair, and highly transparent management and environmentally friendly waste treatment, and, through building relationships with local communities and other stakeholders and providing community-based environmental infrastructure, we aim to enhance the Group's corporate value over the medium- to long-term and achieve sustainable growth for society.

As part of our efforts to address climate change, in June 2022 the Group announced its support for disclosure based on the TCFD recommendations (Task Force on Climate-related Financial Disclosures). Based on our endorsement of the TCFD recommendations, the Group analyzes the risks and opportunities that climate change poses to our business and promotes information disclosure.

Sustainability Promotion System

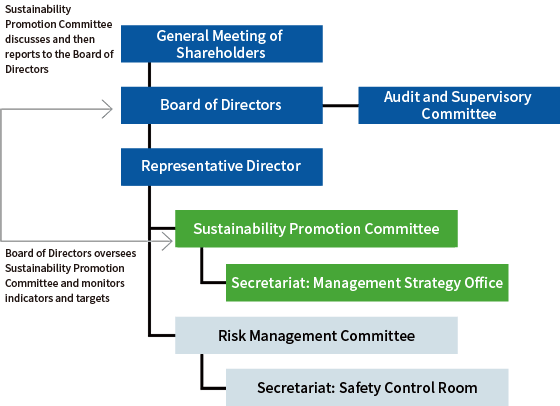

On April 1, 2022, we established the Sustainability Promotion Committee, in order to take a cross-sectional and flexible approach to issues surrounding sustainability, including consideration of climate change and other global environmental issues, respect for human rights, fair and appropriate treatment of employees and their health and working environment, fair and appropriate transactions with business partners, and risk management for natural disasters and other incidents.

The Sustainability Promotion Committee deliberates on matters related to climate change-related risks and opportunities as required by the TCFD, and promotes the Group's sustainability management.

Disclosures Based on TCFD Recommendations

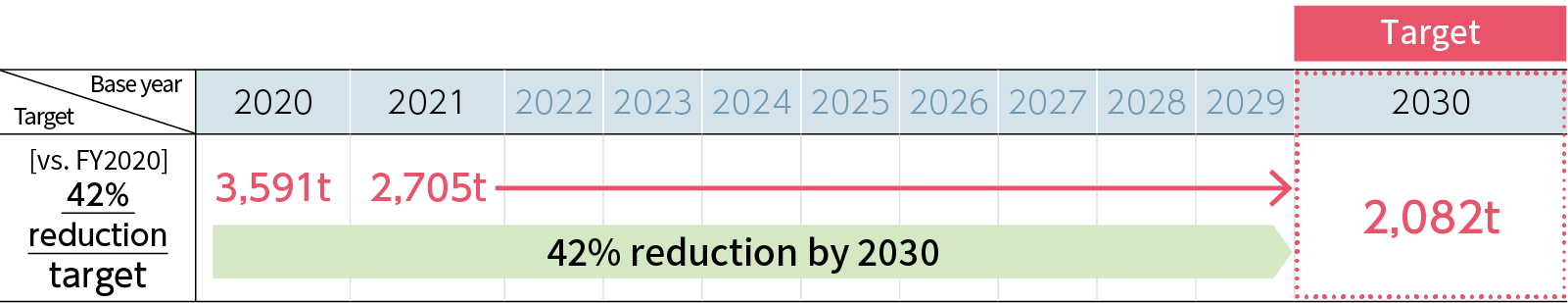

Indicators and Targets

Indicators

Introduction of electric vehicles and improvement to renewable energy procurement rate

Targets

Strategy

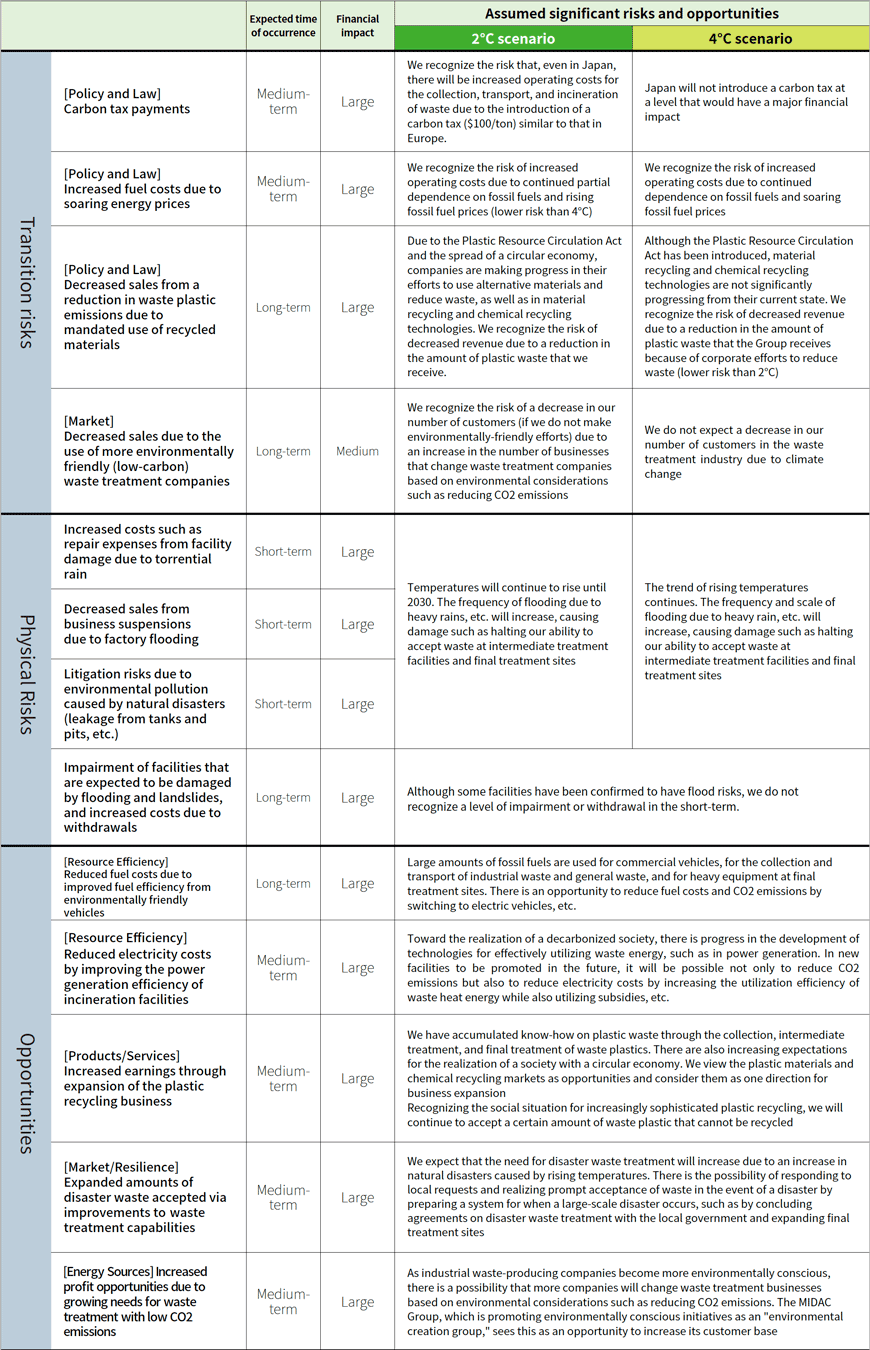

In order to understand business risks and opportunities related to climate change, we conducted scenario analyses, selected climate change risks and opportunities, and evaluated financial impacts. Based on information from the Intergovernmental Panel on Climate Change (IPCC) and the International Energy Agency (IEA), we set two scenarios ((1) Scenario where global average temperature rise is well below 2°C compared to pre-industrial levels, (2) Scenario where global climate change response does not make sufficient progress and global average temperature rise is 4°C) and analyzed the Group's business environment 2030.

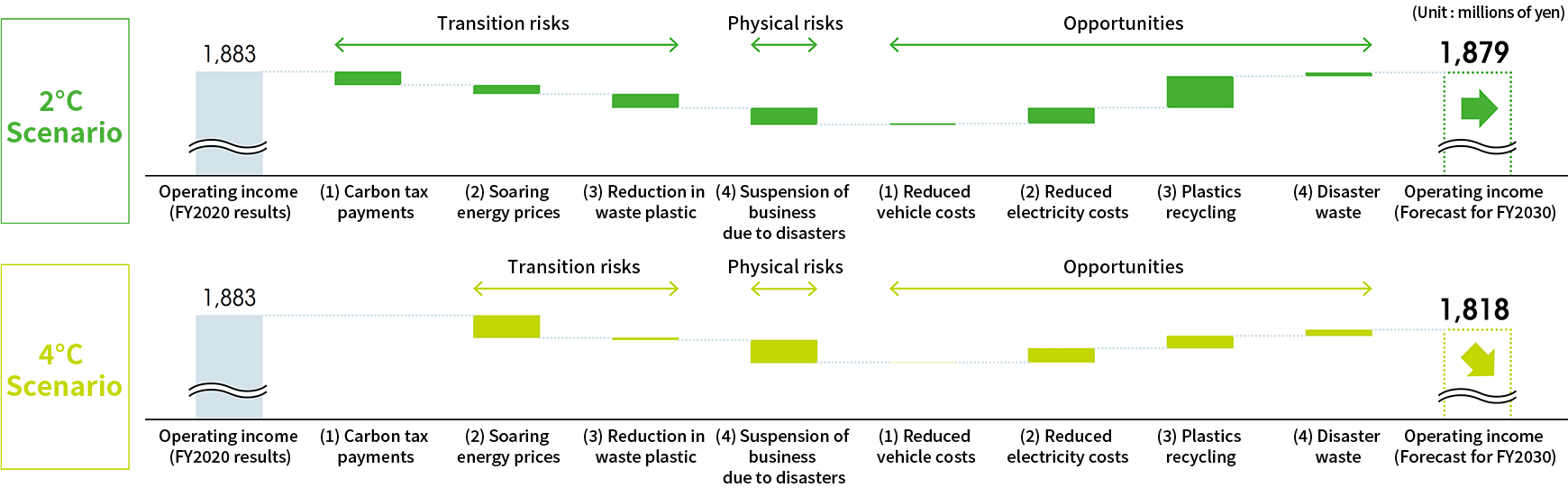

Financial Impact of Risks and Opportunities

As a result of evaluating the financial impact of risks and opportunities that can be quantitatively estimated, operating income of ¥1,879 million (down ¥4 million from FY2020) under the 2°C scenario and ¥1,818 million under the 4°C scenario operating income (down ¥65 million from FY2020) is expected.

Analysis of climate-related risks and opportunities