In order to live up to the trust of our shareholders and investors, we aim to disclose fair and accurate corporate information and improve the quality of our information.

GROUP

- TOP

- Sustainability

- Social

- Relationship with Shareholders and Investors

Sustainability

Relationship with Shareholders and Investors

Basic Policy on Information Disclosures

Our basic policy is to actively disclose information, aiming for "sound and highly transparent management" in order to live up to the trust that society has placed in us. We disclose information in accordance with the Financial Instruments and Exchange Act and with the timely disclosure rules stipulated by the Tokyo Stock Exchange and the Nagoya Stock Exchange. Additionally, we strive to actively disclose information from the perspective of fairness and promptness so that the MIDAC Group can be better understood.

Dialogue with Shareholders and Investors

We believe that it is important to disclose information in a timely manner and to build relationships of trust with our shareholders in order to achieve sustainable growth and to increase corporate value over the medium- to long-term. Through dialogues (interviews) with shareholders and investors, the President & Representative Director explains our management policies, business models, social contribution activities, and other initiatives. This deepens understanding of MIDAC and leads to a composition of stable shareholders over the long-term. For our shareholders and investors, we regularly hold financial results meetings and conduct interviews with individuals upon request. Additionally, opinions and requests obtained through shareholders and investors via our IR activities are reported as necessary to the Board of Directors by the Director in charge of IR.

Basic Policy on Profit Distribution

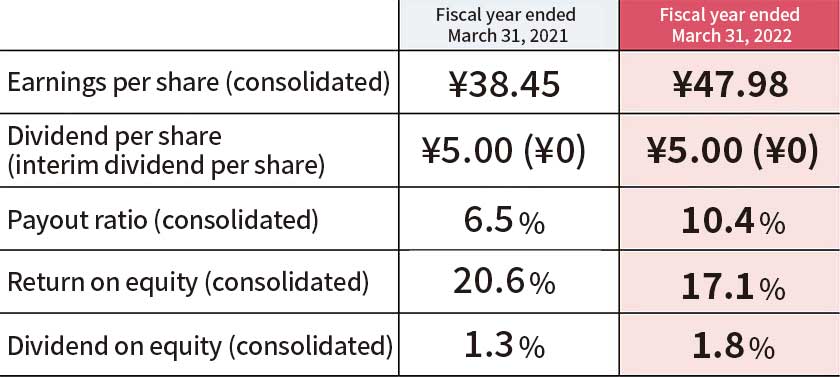

We recognize that increasing shareholder returns by improving corporate value is one of our most important tasks. Our basic policy for profit distribution is to pay stable dividends on an ongoing basis while strengthening our management base and financial position. For FY2021 (ended March 31, 2022), on April 1, 2022, we paid a commemorative dividend of ¥2.5 per share to celebrate the 70th anniversary of our founding and an ordinary dividend of ¥2.5 per share, which resulted in a total dividend of ¥5 per share. As a result, the dividend payout ratio for the current fiscal year was 10.4%.

We intend to make effective use of internal reserves, such as by allocating them to investments aimed at strengthening our management base and by further expanding our business in the future.

Introduction of a Shareholder Benefit Program

We introduced a shareholder special benefit program to thank our shareholders for their continued support and patronage, to further increase understanding of our business amongst as many shareholders as possible, and to increase the attractiveness of investing in our shares so that more people will hold our shares over the medium- to long- term. Shareholders who are recorded in MIDAC's shareholder registry or who are holding one unit (100 shares) or more of MIDAC stock as of March 31, 2022, are eligible for this program.